We adhere to the highest standards of corporate governance to ensure ethical conduct, integrity, transparency, and accountability throughout the organization. This approach allows us to maintain oversight, identify risks, and enhance value for all stakeholders.

Independent Board Members

Chairperson

– Non-Executive Independent

Non-independent Board Members

Female Board

Members

Average median age

of Board Members

Rights and equitable

treatment of shareholders

Communication with shareholders

Related Party Transactions

Shareholder’s Handbook

Conflict of interest

The role of stakeholders in

corporate governance

Stakeholder engagement

Supplier management

Employee welfare

Investor engagement

Whistle-blower policy

Disclosures and

transparency

Ownership structure

Financial and non-financial disclosures

Company filings and quarterly disclosures

Risk management

Transparent and objective disclosures

Dividends and payout policies

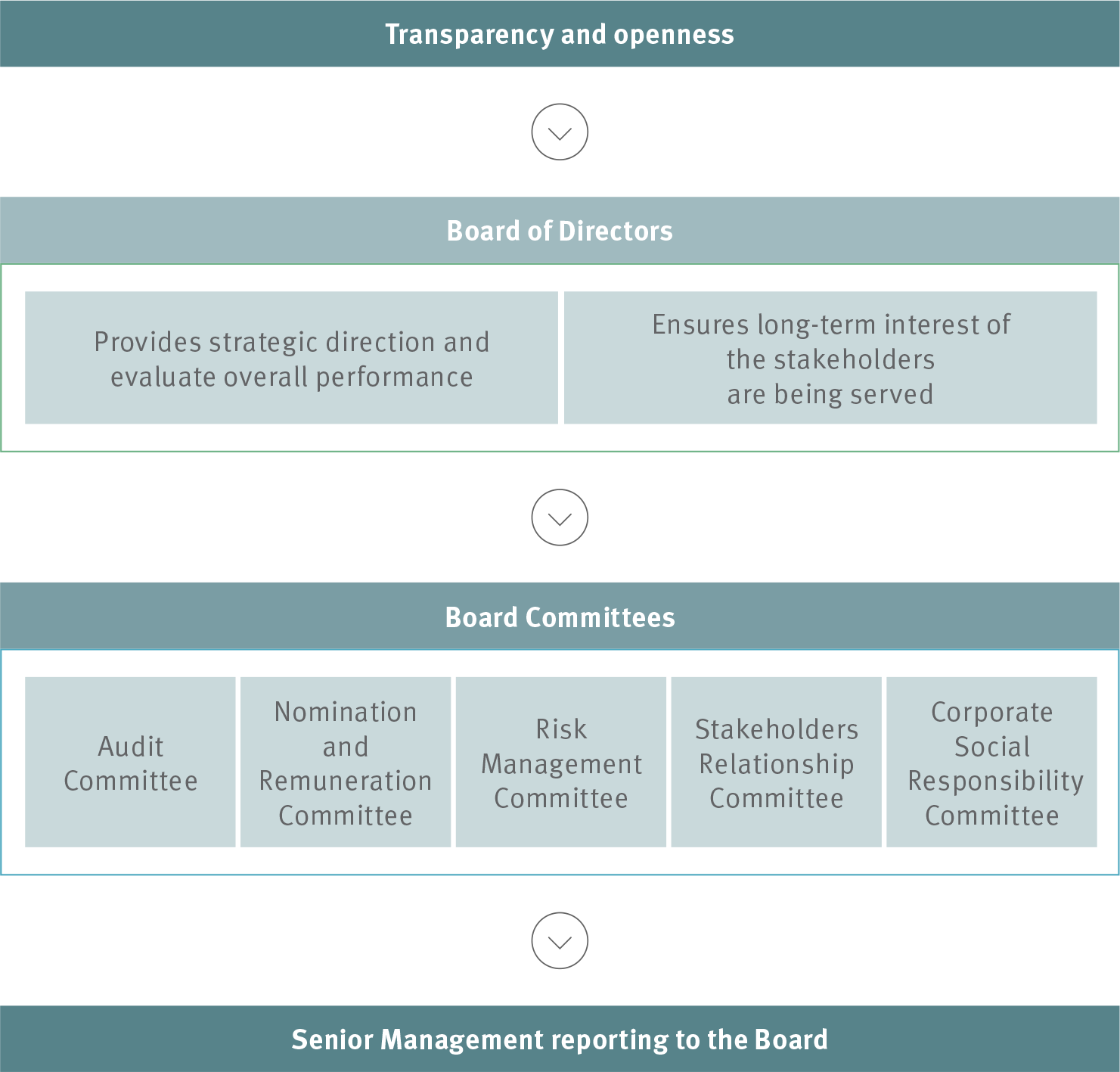

Responsibilities of the Board

and Committees

Board as a trustee

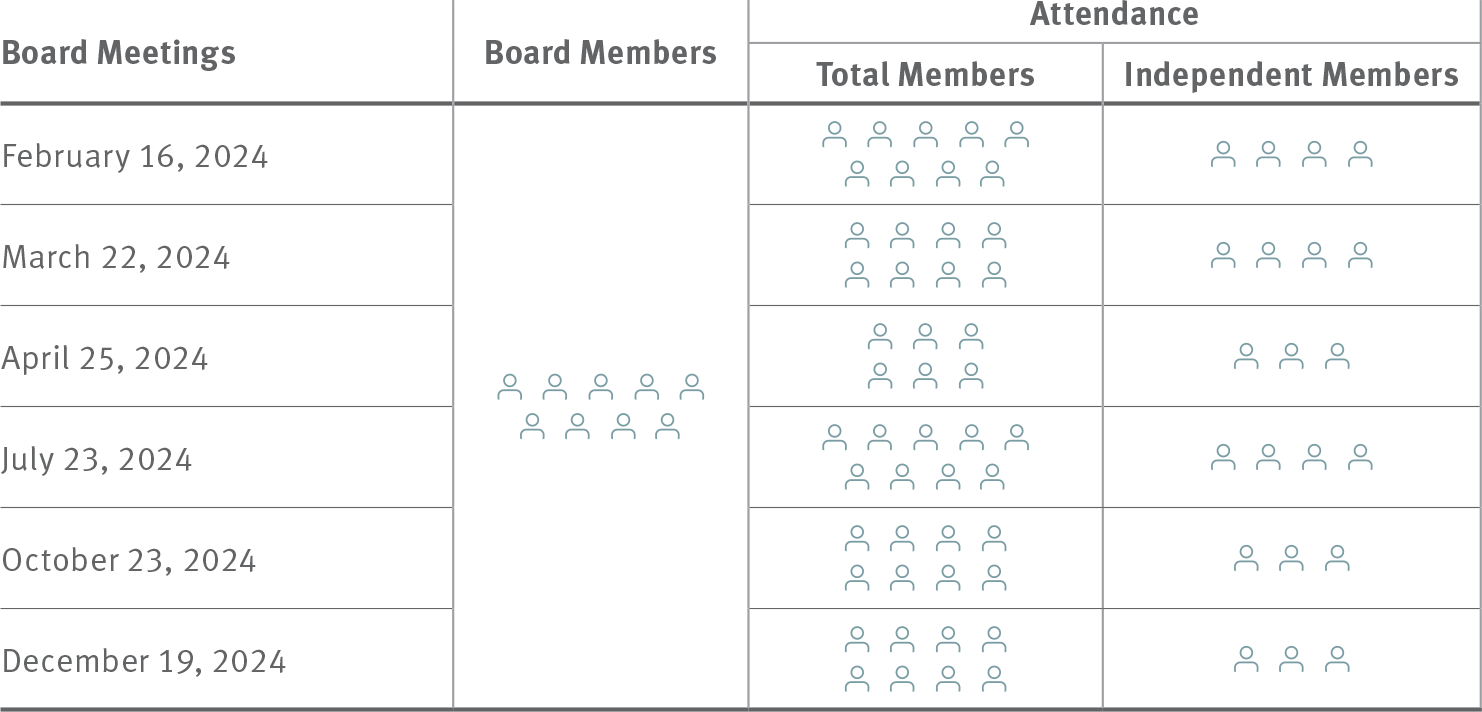

Board and committee composition

Performance review

Succession planning