In alignment with our ‘sustainability to core’ strategy, we undertook our first comprehensive double materiality assessment in 2024, which captures two critical dimensions – ‘financial’ and ‘impact’ materiality principles. The assessment adhered to the double materiality principle, considering both internal (inside-out) and external (outside-in) perspectives.

A sustainability topic is deemed material from a financial perspective if it has, or may have, significant financial implications for Schaeffler. These implications can include a notable effect on the company’s cash flows, performance, development, financial position, cost of capital or access to funding.

A sustainability topic is considered material from an impact perspective if Schaeffler has, or may have, a positive or negative impact - either actual or potential - on people or the environment.

Identifies and prioritises most critical sustainability areas and facilitates strategic decision-making to mitigate risks and maximise returns for shareholders.

A sustainability topic is considered material from an impact perspective if Schaeffler has, or may have, a positive or negative impact - either actual or potential - on people or the environment.

Investors and lenders.

All stakeholders who want to understand impact and contribute to sustainable growth.

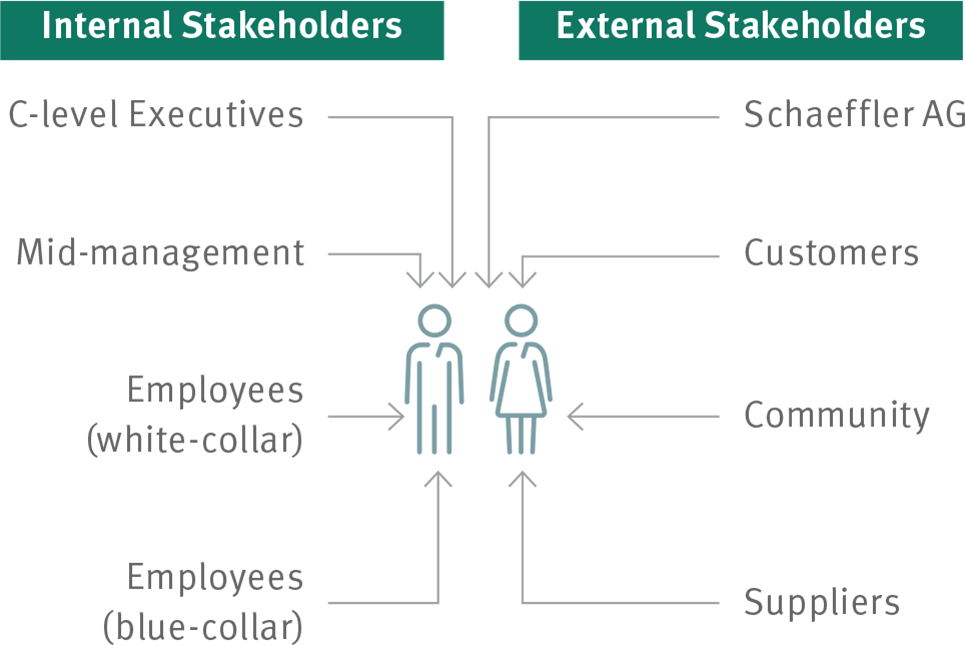

The assessment delves deep into our operational ecosystem, examining: