At Schaeffler India, we are committed to maintaining the highest standards of ethics, integrity, governance and regulatory compliance. Our focus is on creating shared value for all stakeholders by conducting our business in a fair and transparent manner.

Lay emphasis on integrity and accountability

Embrace practices aimed at a high level of business ethics and effective supervision

Provide value enhancement for all stakeholders

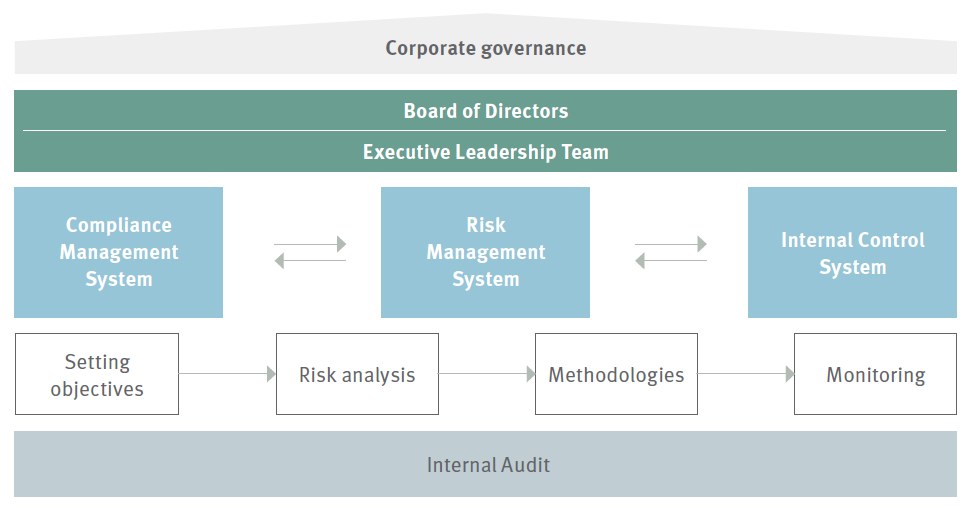

Schaeffler India follows the three pillars in terms of corporate governance in pursuit of long-term enhancement of corporate value

Board of Directors and Senior Management are responsible for establishing measures for corporate governance and ensuring compliance

Compliance Management Risk Management and Internal Control System serve to identify and manage risks

Internal Audit to ensure an independent check on the effectiveness

As the world continues to evolve and transform by the minute, it is extremely crucial for companies to be aware of the existing and emerging risks at all times. Prudent and well-defined risk management practices and policies enable businesses to protect interest of all stakeholders efficiently.

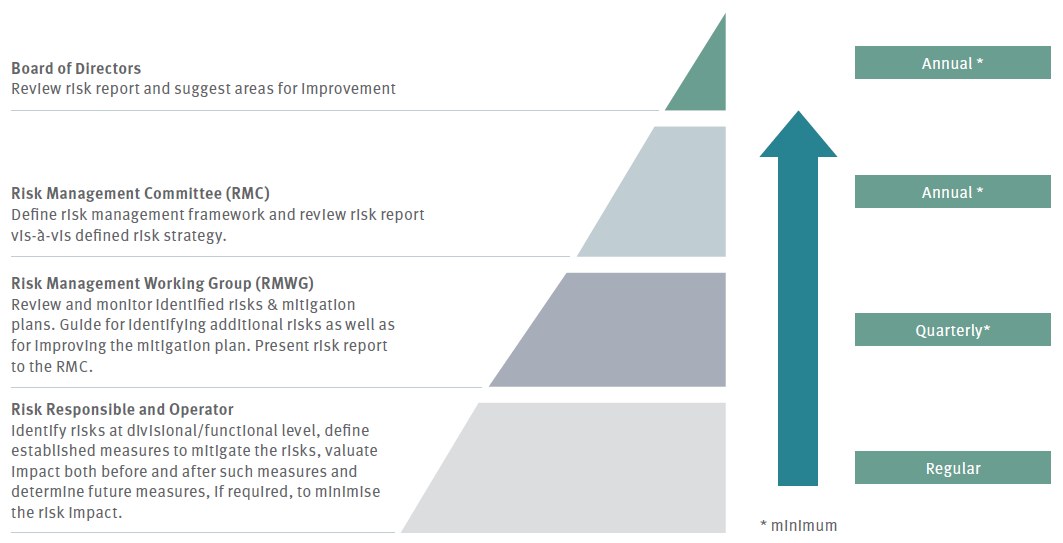

At Schaeffler India, we have adopted a multi-layered process involving the entire organisation, right from the Board of Directors to the risk operator. Our risk management committee oversees this entire process.

Our risk management process

During the year under review, we have constituted a Risk Management Working Group (RMWG) which will operate as an interface between various functions/divisions of Schaeffler India Limited and Risk Management Committee (RMC) of Schaeffler India Board. While on one hand it will monitor, review and guide productive implementation of risk management at Schaeffler India Limited, on the other hand it will provide valued feedback to RMC.

Our bottom-up approach for assessing and managing risks

The risk management strategy as approved by the Board of Directors is implemented by the Company management.

The risk evaluation is performed

semi-annually. The management presents the risk management report along with

planned mitigation measures to the Board of Directors semi-annually.

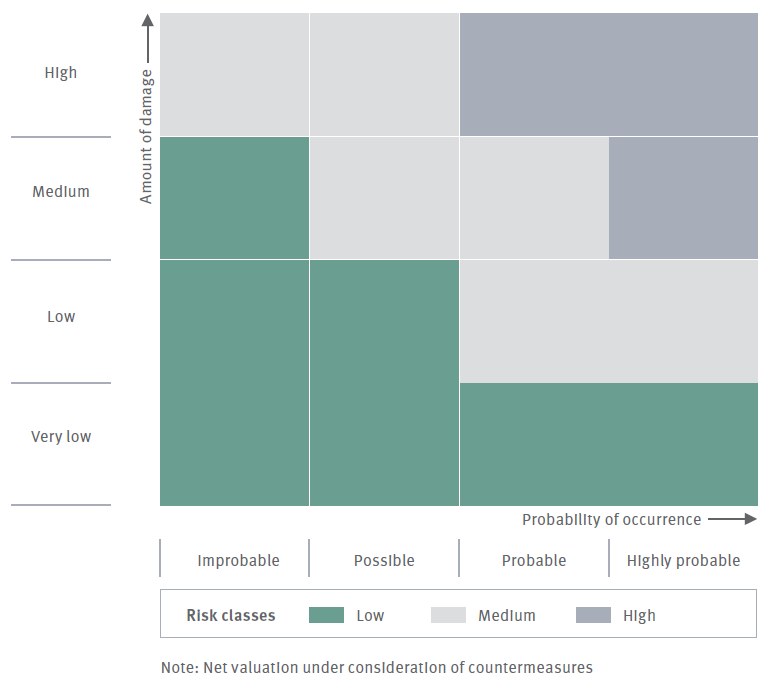

Risk assessment matrix

We have a two-dimensional approach to conducting risk assessment. We look at

the amount of damage each risk can have on an

actual basis and its probability

of occurrence.

Amount of damage: implies financial impact each risk is likely to have on assets and/or earnings of the Company.

Probability of occurrence: implies likelihood of each risk to impact the assets and/or earnings of the Company.

Based on amount of damage each risk is classified as very low, low, medium and high. Probability of occurrence is assessed using percentages and is classified as improbable, possible, probable and high probable. The combination of estimated amount of damage and probability of occurrence determines the risk class, which can be low, medium or high based on its impact on net assets, financial position and earnings.

Each risk is valuated at two stages – before and after putting risk mitigation measures, referred to as gross and net valuation respectively. Risks, based on net valuation are assigned to various risk classes using the risk matrix.

Risk classification

Risks are divided into strategic, operating, legal and financial risks and are described in decreasing order of the magnitude of their impact on the next assets, financial position and earnings of the Company.

Country risks

Changes in the social, political, legal or economic stability within or outside the country could hamper the Company’s regular operations or planned future expansion. Changes in the political and regulatory environment of markets, in which the Company operates, could have an impact on its net assets, financial position, and earnings. During the year 2020, our Company was adversely affected by the spread of pandemic COVID-19.

The social, economic, political risks are mitigated with continuous observations of the developments in relevant business environment and taking appropriate actions in terms of changes in strategies to protect the interest of the Company. Several cost containment measures were identified and implemented in material, employees and process cost to overcome the loss arising out of pandemic.

Strategic market and technology risks

There are transformative changes forecasted in the marketplace like reducing diesel penetration, stricter emission norms, potential electrification of vehicle powertrain and so on. Customers are increasingly looking for bundled offering of products and services. On the manufacturing side, the Company currently relies on a certain degree of vertical integration and comprehensive production expertise that facilitate improvements in the production process and ultimately safeguard the Company’s ability to maintain its competitive position in the market. The evolution of the Company’s business from being component-driven to more systems-based could reduce the proportion of value added by the Company.

The Company is taking a variety of measures to address these trends. It is focusing on development of new evolving technologies and offerings. It is strategically enhancing its production system to be more modular and aiming towards ‘Factory for Tomorrow’. An E-mobility division is dedicated to work on E-mobility solutions for motor and various control modules. It is constantly improving its efficiency in order to safeguard and further expand its market position.

Market developments

As the Company is a supplier in the automotive and industrial sector, demand for Company’s products is, to a large extent, driven by macro-economic conditions. Beside these, in the Automotive OEM division, demand is also affected by changes in consumption patterns, fuel prices, interest rate levels and so on. Cumulatively put together these factors lead to significant volatility in automobile production, which makes exact sales forecasting more difficult. Sales in industrial division is spread across diversified business fields and no significant risks are identified in these markets. A change in forecasted market trends could have an impact on the net assets, financial position, and the earnings of both Automotive and Industrial markets.

Markets are analysed on an ongoing basis in order to detect changes in market structure or regulations early on. The Company uses managed cost efficiency programmes to flexibly and dynamically reduce the amount of damage from unexpected market slowdowns. Should prices deteriorate unexpectedly, the amount of damage arising from the risk is reduced by renegotiating with suppliers as much as possible.

Delivery performance

The ability to deliver and delivery performance represent a key competitive factor for a long-term relationship of trust with customers; this competitive factor is being constantly enhanced by systematic improvements in production and delivery logistics. Inability to meet contractual delivery dates could have an impact on the financial position and earnings of the Company.

The Company has built high-performance distribution centres aimed at improving market supply and delivery performance with strategic logistics locations. Components sourcing options and capacity of critical production lines are being enhanced.

Procurement risks

Procurement risks arise mainly due to raw materials price fluctuations, ability of suppliers to deliver quality products in time. Adverse fluctuations in market prices and/or supplier’s financial distress could have an impact on the Company’s financial position and earnings.

The Company’s purchasing function ensures optimal supply of goods and services to the Company, focusing on quality, cost, and delivery performance. Options for multiple product sourcing and localisation are continuously explored. By negotiating prices and utilising economic synergies, the Company is largely able to obtain competitive prices. The Company keeps a close watch on the operations of its suppliers, by deploying dedicated personnel performing quality checks, for early signs of distress and be able to intervene in order to secure its interests.

Information Technology (IT) risks

The importance of the IT systems utilised across various functions in the Company is growing. The operability of business processes and, therefore, the continuity of operations depend on the availability of IT systems. Three protection targets – confidentiality, integrity and availability – steer the Company’s IT security management and protection of data and IT systems. Unauthorised access to IT systems, modification and misappropriation of sensitive business data could have an impact on the Company’s net assets, financial position and earnings.

The Company has highest standards of IT security systems and constantly upgrade the IT security infrastructure. It educates/trains its employees about IT security and what precautions the users should take, to ensure that the IT infrastructure, business data are adequately protected against any possible IT risks.

Information or cyber security risks

Cyber-attacks/ breaches pose a significant threat to the protection of our intellectual property, and that of our business partners, from theft, loss, unauthorised disclosure, and illegal access or misuse.

Given the increase in both the frequency and sophistication of such attacks, the possibility of cyber-attacks/ breaches cannot be entirely ruled out and could have an impact on the Company’s net assets, financial position and earnings.

To mitigate cyber security risk, the company has put in place a robust information security policy based on the ISO/IEC 27001 standard and taking account of sector-specific regulations. Procedures and other IT security specifications supplement the information security regulations of the Company.

Furthermore, several technical measures have been put in place such as internet proxy gateway with seven layers of security, Advanced Persistent Threat (APT) – one of the latest alarming system for any illegal intrusions, Intrusion Prevention System (IPS) – to mitigate the risk of cyber-attack through unsecured IT environment such as production machines software and hard-disk encryption to secure data theft.

Production risk

As the Company’s manufacturing facility is capital-intensive, a large proportion of its costs are fixed. As a result, decrease in utilisation of plant capacity leads to under absorption of costs and thereby impacts its earnings adversely. Moreover, influence of force majeure could result in delays or interruptions of production and supply chain, leading to non-fulfillment of market demand. The period between failure at plant and arrangement from alternative source could impact the Company’s net assets, financial position and earnings. During the year 2020, the plants were adversely affected by the spread of pandemic COVID-19.

The Company regularly reviews market conditions and aligns its production plan accordingly. Where necessary alternative source can be realised from another plant within Schaeffler Group. To minimise the probability of occurrence of unplanned interruptions, the Company takes extensive fire prevention measures.

Several cost containment measures were identified and implemented in material, employees and process cost to overcome the loss arising out of the pandemic.

Loss of market share

The Company faces competition in all business fields it operates in. As a result, the company is exposed to dual risk of either being displaced by existing or new competitors or its products being replaced by product innovations or by new technological features. Customer dissatisfaction on price, quality, delivery performance and design could lead to loss of market share.

The Company ensures close cooperation with its key customers on product development. It has implemented strict product quality controls in order to reduce the likelihood of substitution.

The Company is also developing products that will help it to step up the value chain from components to systems.

Warranty and liability risks

Our Company is known for its high standard of product quality. It employs a certified quality management system besides continuously striving to improve quality processes. Notwithstanding these, there is a risk that poor quality products get delivered.

Usage of defective parts can lead to damages, unplanned repairs or recall on the part of customer that can result in liability claim or reputational damage.

The Company responds to such risks by adopting strict quality control measures and continually improving its production processes in order to minimise the probability of warranty and liability risks materialising.

Adherence to quality standards are strictly

implemented. All product and recall

liability risks

are insured.

Product piracy risks

Our Company’s product brands - INA, LuK, and FAG are associated with best in class standard of quality, durability and reliability, making them increasingly susceptible to product piracy.

The Company protects intellectual property. It continues to engrave special markings on its products, making it difficult to counterfeit.

Secondly, our Company follows a strict vigilance process to ensure timely detection of counterfeiting instances and initiation of legal actions against the guilty.

Additionally, the Company regularly upgrades its digital anti-counterfeit app to support these initiatives.

Coronavirus pandemic risks

The coronavirus pandemic had prime influence on 2020, particularly in the first half of the year. The government put various containment measures, placing people wellbeing over economic activities. Due to these overall market demand decreased, and supply chain was disrupted. Even the future implications and duration of the pandemic cannot be predicted. The success of the vaccination drive initiated is yet to be ascertained. Threat of second or third wave of pandemic still looms over, which may lead to lockdown like measures be implemented again by the government. These may have an adverse impact on the regular operations and sales of your company.

The Company is continuously and closely monitoring the developments and possible effects that may result from the current pandemic on its financial condition, liquidity and operations and is actively working to minimise the impact of this unprecedented situation.

Compliance risks

As a Company with operations at different locations, it must comply with laws and regulations across the country. It is possible that violations of any existing law occur, despite careful observance of such legal requirements.

The Company has in place a comprehensive Compliance Management System, wherein laws and regulations applicable to the Company are mapped. Each compliance requirement is mapped to relevant process owner. The system sends alerts and reminders to each such process owner to enable him to comply with the requirements in a timely manner.

Our Company’s management regularly reviews a comprehensive compliance report. The system is also updated regularly to capture regulatory changes and amendments.

Tax risks

Our Company is subject to tax audits. Tax authority’s interpretation of the tax law or of relevant facts made in current or future tax audits may differ from that of the Company.

This may lead to adjustments to tax base and increase in the tax liabilities.

An additional tax payment as a result of an adjustment to the tax base could have an impact on the Company’s financial position.

The Company extensively evaluates Corporate Tax and International Tax laws, both internally and with external tax experts, before implementing in the Company.

The implementation strategy is well documented, reviewed periodically and amended as necessary.

Pension risks

Our Company has pension obligations towards its employees.

Such obligations are measured using actuarial valuation based on assumptions with respect to the discount rate, increases in personnel payments and statistical life expectancy.

Planned assets are invested with external agencies, which are subject to fluctuations in value.

A change in these parameters could have an impact on the Company’s net assets.

The Company uses government bond rate as discount rate and invests in pension fund with a Government of India enterprise (LIC).

Quarterly actuarial valuation is carried out, adequate provisions are established in books of accounts and annually funds are appropriately transferred to LIC.

Currency risks

The Company is exposed to currency risks due to its cross-border transactions. The largest currency risks from operations result from fluctuations in the USD and Euro exchange rates.

In 2020, our Company adopted INR as the intercompany invoicing currency with German entities.

This led to substantial reduction in its foreign exchange exposure and nullified currency volatility impact.

Additionally, the Company has a structured hedging strategy to counter currency risks. The strategy is followed consistently and reviewed periodically.

Liquidity risks

The risk that our Company will not be able to meet its payment obligations as they come due is referred to as liquidity risk.

Such risks can arise if financing needs cannot be met by existing funding arrangements including surplus cash balance.

Even though Our Company is cash surplus and does not expect any liquidity risks, it has put efficient liquidity management measures to mitigate associated risks.

The Company monitors liquidity risks using a rolling liquidity plan with a forecast period of 12 months.

Short-term cash flows are monitored daily, involving key stakeholders.

Risk with high probability and high negative impact on financials

Risk with medium probability and medium negative impact on financials

Risk with low probability and medium impact on financials or high probability but negligible impact on financials

Board of Directors

Chairman

Mr. Avinash Gandhi

Managing Director & CEO

Mr. Harsha Kadam

Director – Finance & CFO

Mr. Satish Patel

Directors

Mr. Klaus Rosenfeld

Mr. Jürgen Ziegler

Mr. Dharmesh Arora

Mrs. Renu Challu

Mr. Arvind Balaji

Mr. Amit Kalyani (effective February 11, 2020)

Ms. Eranti V. Sumithasri (effective July 15, 2020)

Company secretary

Mr. Ashish Tiwari (effective February 29, 2020)

Bankers

ICICI Bank Limited

Auditors

B S R & Co. LLP, Chartered Accountants

Collaborators

Schaeffler Group, Germany

Registered office

Nariman Bhavan, 8th Floor, 227, Backbay Reclamation,

Nariman Point, Mumbai – 400 021

Maharashtra, India

Corporate office

15th Floor, ASTP (Amar Sadanand Tech Park) Baner, Pune – 411 045

Manufacturing plants

Sales offices

Navi Mumbai, Bengaluru, Chennai, Coimbatore, Gurugram, Jamshedpur, Kolkata and Secunderabad

Note:

Mr. Rakesh Jinsi (Completed the term as an Independent Director on February 10, 2020)

Mr. R. Sampath Kumar (Ceased to be a Director effective May 30, 2020)

Mr. Chirag K. Shukla (Ceased to be a Company Secretary effective February 29, 2020)